|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Can I Refinance While in Foreclosure: Navigating Options and StrategiesUnderstanding Foreclosure and RefinancingForeclosure can be a daunting process, but you might be wondering if refinancing is an option to help save your home. Let's explore what foreclosure entails and how refinancing could play a role. What is Foreclosure?Foreclosure is a legal process where a lender attempts to recover the balance of a loan from a borrower who has stopped making payments. This typically involves the sale of the property used as collateral for the loan. What is Refinancing?Refinancing involves replacing an existing loan with a new one, usually with better terms such as a lower interest rate. This can potentially make monthly payments more affordable. Can You Refinance During Foreclosure?Refinancing while in foreclosure is challenging but not impossible. Here are a few key considerations:

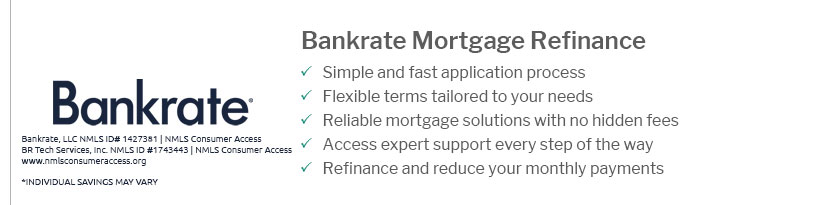

To explore the best home loan refinance deals, it's essential to do your research and understand your current financial situation. Steps to Refinance During Foreclosure

Alternative OptionsIf refinancing is not feasible, you might consider other alternatives like loan modification, a short sale, or a deed in lieu of foreclosure. FAQsIs it possible to refinance with bad credit?Refinancing with bad credit can be difficult, but not impossible. Some lenders specialize in loans for individuals with poor credit, but these often come with higher interest rates. How can I find the best refinance offers?To find the best home loan refinance offers, compare multiple lenders, consider your long-term financial goals, and seek professional advice if needed. What are the risks of refinancing during foreclosure?Refinancing during foreclosure carries risks such as high fees, resetting the loan term, and the possibility of not qualifying. It's crucial to weigh these risks against the potential benefits. https://www.elliotlegal.com/fort-lauderdale-attorney/can-i-refinance-my-home-to-prevent-foreclosure

Typically, refinancing is not an option after a homeowner has defaulted on their mortgage and a lender has begun the process of foreclosure. https://www.quora.com/Can-you-refinance-while-the-home-is-in-foreclosure

You can try! Generally it's in foreclosure for nonpayment and that will affect your credit score. Very few people are willing to lend if your ... https://www.alllaw.com/articles/nolo/foreclosure/obtaining-loan.html

If you're facing a foreclosure, you might be able to refinance your loan or take out a reverse mortgage to save your home. But refinancing could be difficult.

|

|---|